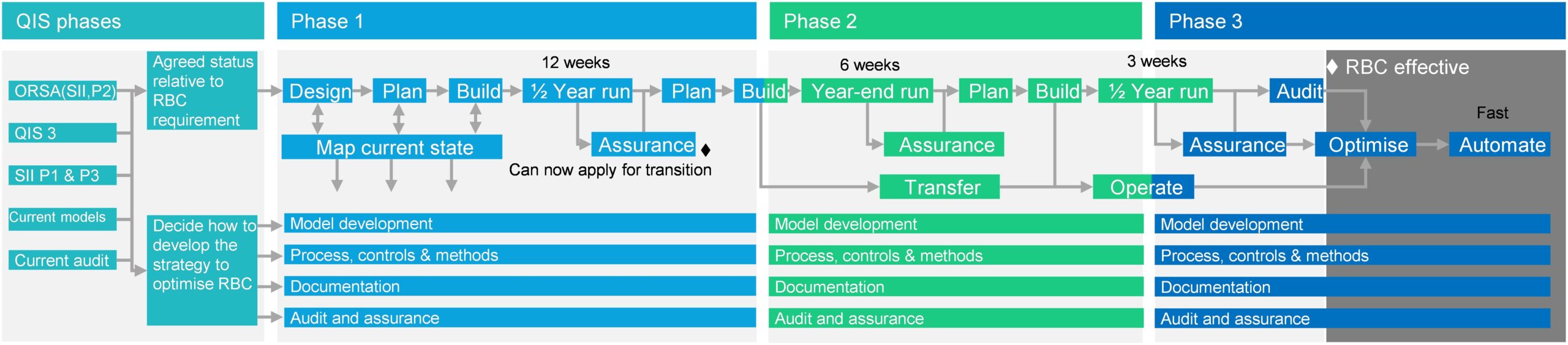

RBC implementation roadmap

Implementing RBC starts with understanding its impact and the opportunities.

It ends with optimised capital management and an automated reporting process. Between these two there are a series of phases. These take the insurer through its application to IA, approval by the auditor, making changes to its business model and minimising the operation overhead of reporting. Approaching work in this manner, the insurer will set themselves up to deliver the work in a smooth transition through three implementation phases:

- QIS phases – Understand position. Where the insurer assesses the impact, challenges and opportunities that lie in transition to RBC.

- Phase 1 – Bespoke build. First development phase that results in an application to the IA.

- Phase 2 – Partial Production. Get RBC transferred into the business and learning to operationalise it.

- Phase 3 – Full production and automation. Optimising and automating the workflow.

A 'minimum-action' route is possible through the builds and half-yearly runs. The critical path item is assurance by the external auditor. This is the paramount relationship in the project. Consequently, before proceeding, every insurer must establish how it is going to work with and maintain attention of its auditor (or appointed expert).

Implementation roadmap

To read our full implementation roadmap paper, enter your name and email address below and click submit: